Correlation analysis diversification is a fundamental concept in modern portfolio management, serving as a cornerstone for investors seeking to optimize their investment strategies. By examining the relationships between various assets, investors can create well-balanced portfolios that aim to maximize returns while minimizing risk. This approach, rooted in the groundbreaking work of Nobel laureate Harry Markowitz, has transformed the way financial professionals approach asset allocation and risk management.

Correlation analysis in investment refers to the statistical measure of how two securities move in relation to each other. This metric is crucial for investors looking to build diversified portfolios, as it helps identify assets that may offset each other’s volatility. The importance of correlation analysis cannot be overstated, as it forms the basis for Modern Portfolio Theory, which emphasizes the benefits of diversification in reducing overall portfolio risk.

The primary metric used in correlation analysis is the correlation coefficient, which ranges from -1 to +1. A coefficient of +1 indicates perfect positive correlation, -1 represents perfect negative correlation, and 0 suggests no correlation. Other essential calculations include covariance, which measures the degree to which two variables change together, and the coefficient of determination, which indicates the proportion of variance in one variable that is predictable from another.

Interpreting correlation coefficients requires a nuanced understanding of market dynamics. For instance, a correlation of 0.7 between two stocks suggests a strong positive relationship, meaning they tend to move in the same direction. Conversely, a correlation of -0.5 indicates a moderate negative relationship, where one asset tends to rise as the other falls. This interpretation is crucial for investors seeking to balance their portfolios and mitigate risk through diversification.

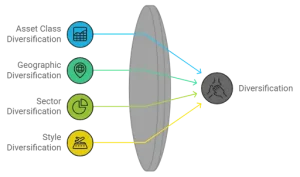

Diversification is a risk management technique that involves spreading investments across various financial instruments, industries, and other categories. The primary benefit of diversification is the reduction of unsystematic risk, also known as specific risk, which is unique to individual securities or sectors. By combining assets with low or negative correlations, investors can potentially achieve more stable returns over time.

There are several approaches to diversification, including:

While diversification offers numerous benefits, it’s not without limitations. Over-diversification can lead to diminishing returns and potentially higher transaction costs. Additionally, during market-wide crises, correlations between assets may increase, reducing the effectiveness of diversification. Investors must strike a balance between diversification and maintaining a focused portfolio that aligns with their investment objectives.

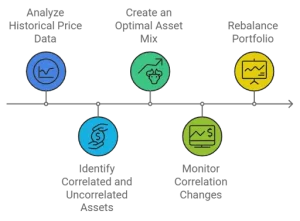

Effective diversification relies on identifying assets with low or negative correlations. This process involves analyzing historical price data and calculating correlation coefficients between different securities. For example, traditionally, stocks and bonds have shown low correlation, making them popular choices for diversified portfolios. However, correlations can change over time, necessitating ongoing analysis and portfolio adjustments.

Once correlations are established, investors can use tools like mean-variance analysis to create an optimal asset mix. This approach, developed by Harry Markowitz, aims to find the most efficient combination of assets that maximizes expected return for a given level of risk. The resulting set of optimal portfolios forms the Efficient Frontier, a key concept in Modern Portfolio Theory.

As market conditions evolve, correlations between assets may shift, requiring periodic portfolio rebalancing. Rebalancing strategies based on correlation changes involve monitoring the relationships between assets and adjusting allocations to maintain the desired risk-return profile. This dynamic approach ensures that the portfolio remains diversified and aligned with the investor’s goals over time.

Factor analysis is an advanced technique that examines the underlying drivers of asset returns. By identifying common factors that influence multiple securities, investors can achieve more sophisticated diversification. Style investing, which focuses on factors like value, growth, and momentum, allows for a more nuanced approach to portfolio construction and risk management.

Traditional correlation analysis often relies on static, historical data. Dynamic correlation models, however, account for the time-varying nature of asset relationships. These models use advanced statistical techniques to capture changing correlations, providing a more accurate picture of portfolio risk and potential diversification benefits in different market conditions.

The advent of machine learning has opened new avenues for correlation analysis and diversification. Artificial intelligence algorithms can process vast amounts of data to identify complex, non-linear relationships between assets. These techniques offer the potential for more robust diversification strategies that adapt to changing market dynamics in real-time.

Implementing correlation-based diversification strategies requires sophisticated tools and software. Popular platforms like Bloomberg Terminal, FactSet, and Morningstar Direct offer comprehensive correlation analysis features. Additionally, open-source programming languages such as Python and R provide flexible options for custom correlation analysis and portfolio optimization.

Examining real-world examples can provide valuable insights into the practical application of correlation-based diversification. For instance, during the 2008 financial crisis, many investors learned the hard way that correlations can increase dramatically during market stress, highlighting the importance of ongoing analysis and dynamic portfolio management.

Some common pitfalls in correlation-based diversification include:

To avoid these pitfalls, investors should adopt a comprehensive approach that combines historical analysis with forward-looking scenarios and considers the practical implications of implementation.

The proliferation of alternative data sources, such as satellite imagery, social media sentiment, and mobile device usage patterns, is expanding the scope of correlation analysis. These non-traditional data sources can provide unique insights into asset relationships and potential diversification opportunities that may not be apparent from conventional financial data alone.

As artificial intelligence and machine learning technologies continue to advance, their role in portfolio optimization is likely to grow. These technologies can process vast amounts of data, identify complex patterns, and make real-time adjustments to portfolio allocations based on changing market conditions and correlations.

The ongoing development of emerging markets presents new opportunities for global diversification. As these markets mature and become more accessible to international investors, they offer the potential for enhanced portfolio diversification and risk-adjusted returns. However, investors must carefully consider the unique risks and correlations associated with emerging market investments.

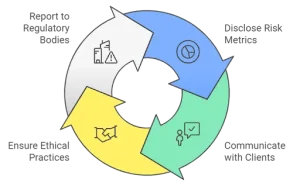

Regulatory bodies such as the Securities and Exchange Board of India (SEBI) and international counterparts have established reporting requirements for portfolio managers implementing diversification strategies. These requirements often include disclosing risk metrics, correlation assumptions, and the methodologies used in portfolio construction.

Effective communication with clients about the benefits and limitations of correlation-based diversification is crucial. This includes providing clear explanations of risk metrics, potential scenarios that could impact portfolio performance, and the rationale behind specific diversification strategies.

Ethical considerations play a vital role in implementing correlation-based diversification strategies. Portfolio managers must ensure that their approaches align with clients’ best interests, avoiding conflicts of interest and maintaining transparency in their decision-making processes.

In conclusion, correlation analysis diversification remains a cornerstone of modern portfolio management, offering investors a powerful tool for optimizing risk-adjusted returns. As technology advances and markets evolve, the application of correlation analysis in diversification strategies continues to grow in sophistication and effectiveness. By embracing innovative techniques, leveraging alternative data sources, and adhering to regulatory requirements, investors can harness the full potential of correlation analysis diversification to navigate complex financial landscapes and achieve their investment objectives.

Talk to us

Talk to us

Investor Grievance

Investor Grievance